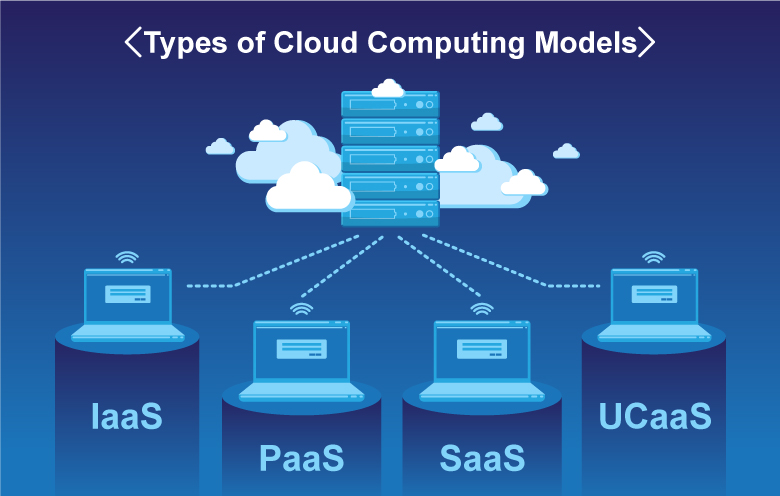

Shared Cloud Infrastructure Spending Rose 115.3 Percent YoY to Reach $57.3 Billion in Q3 2024 : IDC

According to IDC's Worldwide Quarterly

Enterprise Infrastructure Tracker: Buyer and Cloud Deployment, spending on

compute and storage infrastructure products for cloud deployments, including

dedicated and shared IT environments, increased 115.3 percent year-over-year in

the third quarter of 2024 (Q3 2024) to $57.3 billion.

Spending on cloud infrastructure continues to outgrow the

non-cloud segment with the latter growing by 28.6 percent in Q3 2024 to $19.6

billion. The cloud infrastructure segment experienced a lower growth in unit

demand of 15.6 percent, due to a continued increase in ASPs mostly related to

the exponential increase of GPU server shipments.

"Cloud infrastructure spending growth continues being

driven by accelerated servers related investments that not only aim to cover AI

initiatives, but also support large HPC projects that were unveiling

recently," said Juan Pablo Seminara, Director for IDC's Worldwide

Enterprise Infrastructure Trackers. "After a year where the demand was

focus on serve infrastructure build-up for AI model development and training,

we will start to see more investments oriented to AI model inferencing that

will shift demand towards less dense GPU based platforms, that of course will

continue be demanded throughout 2025 and beyond, but with a less aggressive

pace than last year."

Spending on shared cloud infrastructure reached $47.9 billion

in the quarter, increasing 136.5 percent compared to a year ago. The shared

cloud infrastructure category continues capturing the largest share of spending

compared to dedicated deployments and non-cloud spending, in Q3 2024 shared

cloud accounted for 62.4 percent of the total infrastructure spending. The

dedicated cloud infrastructure segment presented lower growth of 47.6 percent

year-over-year in Q3 2024 to $9.3 billion.

For 2024, IDC is forecasting cloud infrastructure spending to

grow 74.3 percent compared to 2023 to $192 billion. Non-cloud infrastructure is

expected to grow 17.9 percent to $71.4 billion. Shared cloud infrastructure is

expected to grow 88.9 percent year over year to $157.8 billion for the full

year, spending on dedicated cloud infrastructure is also expected to have a

double-digit growth in 2024 with 28.6 percent to $34.2 billion for the full

year. The subdued growth forecast for non-cloud infrastructure at 17.9 percent

in 2024 reflects that even though most of the growth will come from cloud

spending, general non-cloud dedicated systems are consolidating the recovery

this year.

IDC's service provider category includes cloud service

providers, digital service providers, communications service providers,

hyperscaler and managed service providers. In Q3 2024, service providers as a

group spent $54.2 billion on compute and storage infrastructure, up 113.8

percent from the prior year. This spending accounted for 70.6 percent of the

total market. Non-service providers (e.g., enterprises, government, etc.) also

increased their spending to $22.6 billion growing 37.5 percent year-over-year.

IDC expects compute and storage spending by service providers to reach $183.1

billion in 2024, growing at 73.5 percent year-over-year.

On a geographic basis, year-over-year

spending on cloud infrastructure in Q3 2024 showed very positive results across

all regions where the fastest growing regions were USA and China showing triple

digit growth of 148.3 percent and 100 percent, respectively. The regions that

showed double digit growth were APeJC, Japan, Western Europe, Canada and Latin

America with 90.3 percent, 73.5 percent, 40.1 percent, 38.5 percent and 34.8

percent, respectively. While Middle East and Africa showed one digit growth of

6.7 percent, Central and Eastern Europe was the only one declining at -1.7

percent.

Long term, IDC predicts spending on cloud infrastructure to

have a compound annual growth rate (CAGR) of 24.2 percent over the 2023-2028

forecast period, reaching $325.5 billion in 2028 and accounting for 78.8

percent of total compute and storage infrastructure spend. Shared cloud

infrastructure spending will account for 79.1 percent of the total cloud

spending in 2028, growing at a 25.2 percent CAGR and reaching $257.4 billion.

Spending on dedicated cloud infrastructure will grow at a

CAGR of 20.7 percent to $68.2 billion. Spending on non-cloud infrastructure

will also rebound with a 7.6 percent CAGR, reaching $87.5 billion in 2028.

Spending by service providers on compute and storage infrastructure is expected

to grow at a 17.1 percent CAGR, reaching $233 billion in 2028.

Leave A Comment