IoT in Automotive Market $102.3 Billion in 2022 to $760.3 Billion by 2032, with a CAGR of 22.6%

According to a recent

report published by Allied Market Research, titled, The global IoT in

automotive market was valued at $102.3 billion in 2022, and is projected

to reach $760.3 billion by 2032, growing at a CAGR of 22.6% from 2023 to 2032.

𝐆𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐚𝐠𝐞𝐬 & 𝐓𝐎𝐂

The

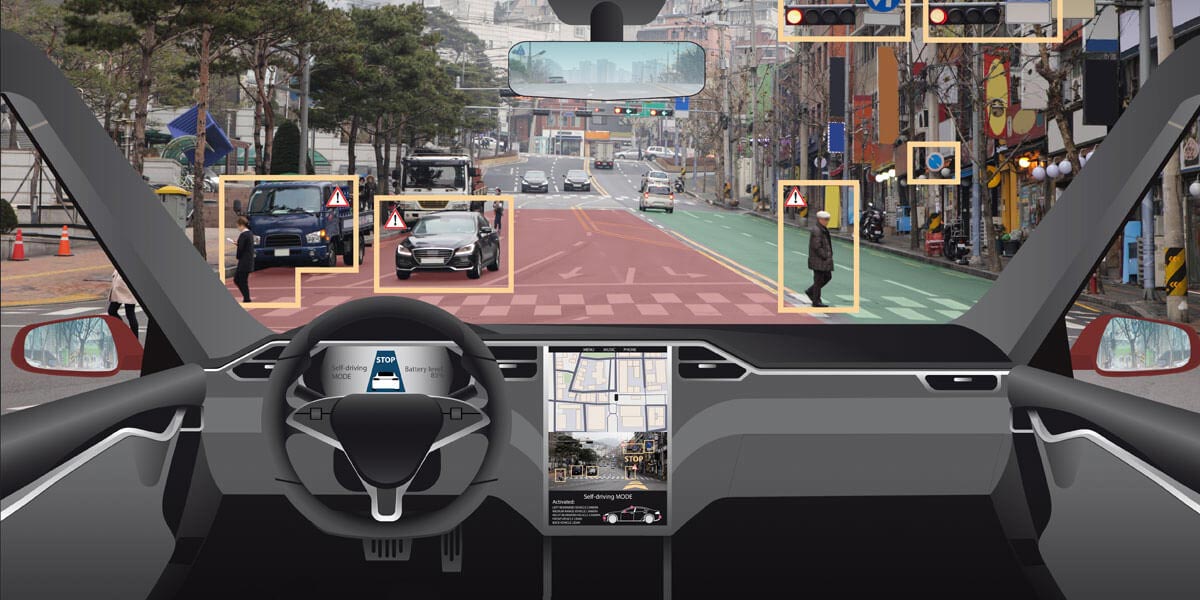

Internet of Things (IoT) elaborated as a major factor transforming the

automotive industry. With the incorporation of IoT technologies into vehicles,

car manufacturers and consumers alike are undergoing an asset of benefits.

IoT's impact on the automotive sector is the concept of connected cars. These

smart vehicles are equipped with embedded sensors and internet connectivity,

enabling them to gather and exchange real-time data with external systems,

other vehicles, and even infrastructure.

Moreover,

the market is affected in European states by strict government regulations. The

European Union has executed regulations and proposals focused on road safety,

emissions reduction, and the enhancement of smart mobility solutions. For

instance, in May 2022, the European Commission mandated the deployment of

eCall, a telematics system that automatically contacts emergency services in

the event of a serious accident. Such regulations drive the integration of IoT

technologies in vehicles. Moreover, the countries in Europe also have general

exposure to 4G and 5G networks, allowing continuous connectivity and high-speed

data transmission which supports a range of services, including real-time

navigation, distant diagnostics, over-the-air updates, and vehicle-to-vehicle

(V2V) and vehicle-to-infrastructure (V2I) communication.

For

IoT technologies to drive effectively in vehicles, there is a need for strong

connectivity infrastructure, including widespread network coverage and

consistent communication standards. However, in some areas, the necessary

infrastructure may be lacking or underdeveloped, hindering the seamless

integration and functioning of IoT systems in vehicles. In additionally, the

lack of interoperability between different IoT devices and platforms presents

challenges in achieving seamless communication and data exchange.

𝐏𝐫𝐨𝐜𝐮𝐫𝐞 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰

For

instance, different automakers and technology providers may use proprietary

systems and protocols, making it difficult for vehicles and IoT devices from

different manufacturers to work together smoothly. This lack of

interoperability can limit the scalability and widespread adoption of IoT

technologies in the automotive sector. Thus, initiatives by OEMs further

provide lucrative growth opportunities for market growth.

The IoT

in automotive industry size is segmented based on communication,

connectivity, application, and region. By communication, the market is segmented

into the vehicle to vehicle, In-vehicle communication and

vehicle-to-infrastructure. Further, by connectivity, the market is segmented

into embedded, tethered and integrated. By application, the market is segmented

into navigation, infotainment, telematics, and others. By region, the market is

analyzed across North America, Europe, Asia-Pacific, and Latin America, Middle

East & Africa (LAMEA) including country-level analysis for each region.

On

the basis of application, the market is divided into infotainment, navigation,

telematics and others. The navigation segment includes the combination of GPS

(Global Positioning System) technology, real-time traffic information, and

connectivity within vehicles to give navigation and routing services.

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐌𝐚𝐫𝐤𝐞𝐭 𝐏𝐥𝐚𝐲𝐞𝐫𝐬 are AT&T, Cisco

System, Inc., Alphabet Inc., Intel, Microsoft Corporation, NXP Semiconductors, Robert

Bosch, Texas Instruments

Thales SA and TOMTOM

The growing adoption of connected vehicles

presents a major growth opportunity for navigation applications in the IoT

automotive market. Connected vehicles are equipped with internet connectivity

and advanced communication capabilities, allowing seamless integration with

navigation applications. As more vehicles become connected, the demand for

navigation applications that leverage IoT connectivity to provide real-time

navigation services will increase. For instance, in November 2021, Google

entered into the original equipment manufacturers' (OEM) navigation and

location-based services. The rapid adoption of Google's Android Automotive

Operating System (AAOS) by OEMs and the default inclusion of Google Maps on the

platform gives the already popular service an even greater strategic advantage.

Leave A Comment