India's E-Commerce Market to Reach $147 billion in 2024, Up 23.8 Percent:: GlobalData

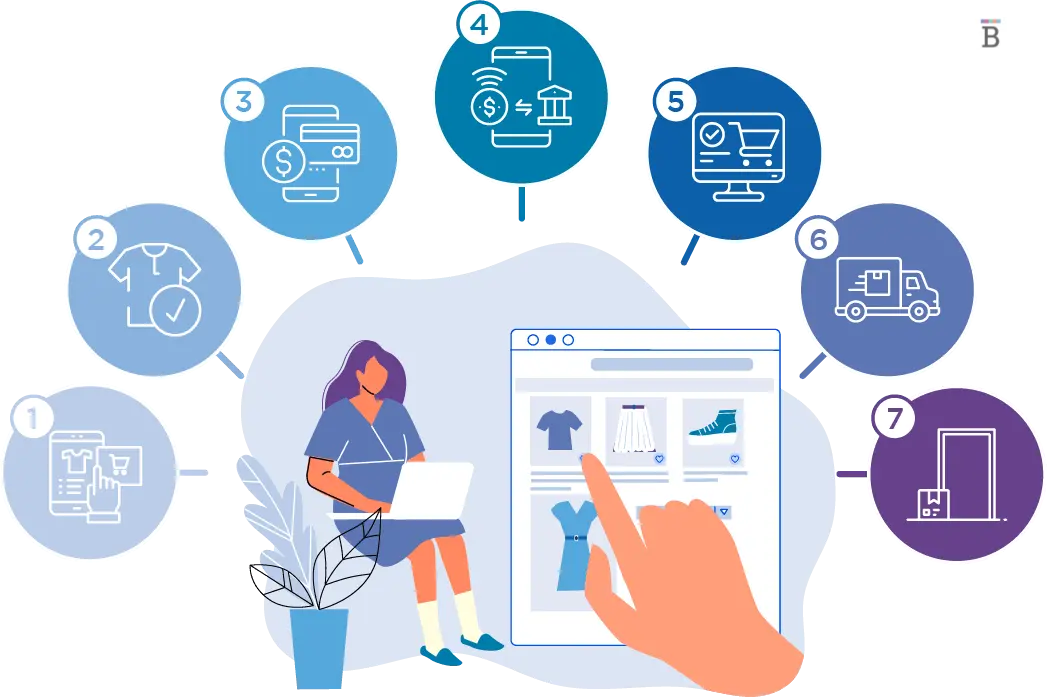

According to GlobalData, the Indian

e-commerce market is growing at a fast pace and is expected to surge by 23.8

percent to reach Rs. 12.2 trillion ($147.3 billion) in 2024, driven by growing

consumer preference for online shopping and strong Internet penetration.

An analysis of GlobalData's E-Commerce Analytics reveals that

India's e-commerce market value is set to increase to Rs. 24.1 trillion ($292.3

billion) in 2028, registering a compound annual growth rate (CAGR) of 18.7

percent during 2024-28.

Ravi Sharma, Lead Banking and Payments Analyst, GlobalData,

said, "India's e-commerce market is growing at a healthy pace, supported

by increasing Internet penetration (especially in rural areas), and improving

digital payment infrastructure. Online shopping events have also contributed to

e-commerce growth."

According to the Telecom Regulatory Authority

of India, as of March 2024, there were 954 million Internet subscribers, up

from 881 million in March 2023. This strong momentum is encouraging merchants,

especially SMEs, to enter the e-commerce space.

Many domestic and international e-commerce retailers such as

Flipkart, Amazon and Myntra offer benefits, including discounts and cashback on

various products listed on their platforms through their respective shopping

events, Flipkart Big Billion Days, Amazon Great Indian Sale and Myntra Big

Fashion Festival Sale, thereby encouraging consumers to shop online.

Among payment tools, alternative payment solutions are most

preferred by online shoppers. Mobile and digital wallets have eclipsed

traditional payment modes, reflecting a paradigmatic change in consumer

preferences and transactional behavior. Alternative payment solutions have

consistently gained popularity among Indian consumers in the last five years, with

some of the popular brands being Amazon Pay and Google Pay.

According to GlobalData's 2024 Financial Services Consumer

Survey, 30 percent respondents indicated using Google Pay most frequently while

buying goods and services online. This is distantly followed by PhonePe (13

percent), Amazon Pay (13 percent) and Paytm (12 percent).

Alternative payments are followed by credit and charge cards

(10 percent), as these cards are preferred due to various reward and pricing

benefits associated with these cards.

With electronic payment methods being accepted for

pay-on-delivery orders, e-commerce payments are expected to see further

increase from such offerings. For instance, Flipkart offers the QR code

Pay-On-Delivery facility, allowing shoppers to opt for QR code payments at the

time of delivery using any UPI-enabled apps such as PhonePe, Google Pay and

MobiKwik.

"The uptrend in e-commerce sales in India is likely to

continue over the next few years, supported by improving payment infrastructure

and the growing popularity of alternative payment solutions," said Sharma.

Leave A Comment