Smart Factories on the Rise & IoT Reshapes the Manufacturing Landscape 2030

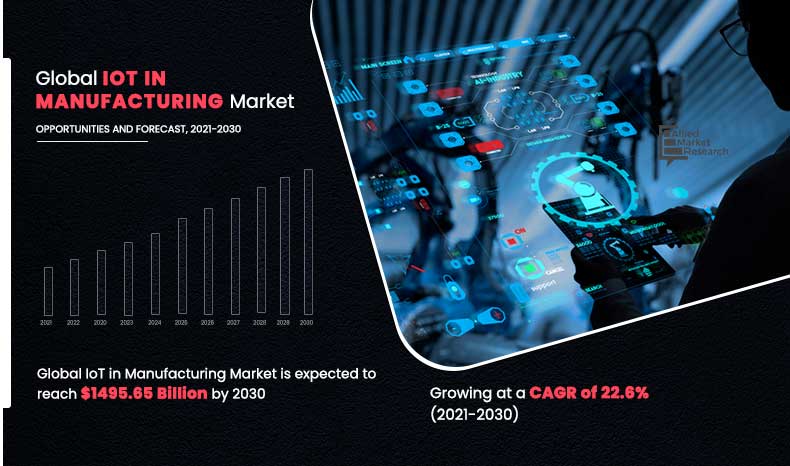

According to a recent report published by Allied Market Research,

titled, “IoT in Manufacturing Market by

Component, and Application: Global Opportunity Analysis and Industry Forecast,

2021–2030,” the global IoT in manufacturing market size was valued at $198.25

billion in 2020, and is projected to reach $1,495.65 billion by 2030, growing

at a CAGR of 22.6% from 2021 to 2030.

The service segment

is expected to experience fastest growth in the coming years, as services

speeds up software implementation, maximizes the value of existing installation

by optimizing it, and minimizes the deployment cot & risks. In addition,

services ensure effective functioning of software throughout the process, which

fuel the growth of the market.

Manufacturing

businesses employ IoT as a digital transformation strategy to enhance workforce

and machine efficiency. Through a network of sensors, vital production data is

collected, and cloud-based analytics software is employed to convert this data

into actionable information. The integration of IoT enables manufacturing

facilities to streamline operations, leading to cost reduction and faster

production cycles.

Manufacturing

companies leverage Internet of Things (IoT) technologies to access a range of

software and services, facilitating the implementation of IoT-based solutions

like predictive maintenance, supply chain management, and quality control. The

integration of connected operational intelligence and real-time asset

monitoring enhances manufacturing processes. The growth of the IoT in

manufacturing market is propelled by technological advancements such as smart

sensors and virtual/augmented reality, along with the benefit of low

operational costs.

Additionally, the

increasing demand for real-time asset monitoring contributes positively to

market expansion. However, challenges related to inadequate IT infrastructure

impede growth. Conversely, the introduction of connected operational

intelligence and the rising adoption of cloud-based deployment models present

lucrative opportunities for the forecasted growth of the IoT in manufacturing

market.

The market faces

significant constraints, including insufficient infrastructure, awareness, and

capital. Businesses that suffered losses during the pandemic are now compelled

to survive with limited capital. Additionally, the market growth is hindered by

the availability of semi-automatic alternatives at affordable prices. Another

limiting factor is the integration of standards in Machine-to-Machine (M2M)

communication, which poses challenges despite increasing user-friendliness and

versatility.

The market is

categorized by service into Professional Services, System Integration and

Deployment Services, Managed Services, and Other Services. The Managed Services

segment is anticipated to dominate the market during the forecast period,

driven by the widespread adoption of Managed Services in the U.S. and Canada.

Managed services play a crucial role in implementing IoT solutions tailored to

client needs, addressing pre- and post-deployment queries. These services

encompass planning, design, testing, integration, maintenance, and support, often

outsourced for timely delivery, leading to reduced capital and operational

expenses. Managed service providers facilitate communication across diverse

business sectors and regions, delivering pertinent information related to

intelligent design and operations.

The market is

divided into various segments based on solutions, including Data Management,

Network Management, Device Management, Connectivity Management Platform,

Application Management, and Smart Surveillance. The Data Management segment is

anticipated to experience the highest Compound Annual Growth Rate (CAGR) during

the forecast period. This is attributed to the increasing volume of data stored

in IoT devices. With devices and sensors generating large amounts of data,

traditional data management infrastructure and processes are no longer

sufficient for effective control and operation of IoT. To address this,

organizations are integrating data management directly into the devices and

sensors, facilitating a seamless and continuous flow of information in manufacturing

operations and ultimately enhancing manufacturing efficiency.

The software

segment took the lead in the overall IoT in manufacturing market in 2020 and is

projected to maintain its dominance in the forecast period. This can be

attributed to the growing adoption of IoT in manufacturing by enterprises

seeking strategic and competitive advantages over their peers. The integration

of IoT enables quick and informed decision-making through the analysis of

business data, contributing to market growth. However, the services segment is

expected to experience the highest growth, ensuring the effective operation of

software throughout the entire process. These services accelerate software

implementation, optimize the value of existing installations, and reduce

deployment costs and risks, further driving market expansion.

In terms of

geographical distribution, North America held the reins in the IoT in

manufacturing industry in 2020 and is anticipated to uphold its position in the

forecast period. This is due to a significant shift toward digital transformation,

increased cloud deployment among small and medium businesses, and the ongoing

modernization of manufacturing, leading to substantial investments in the IoT

in manufacturing market in the U.S. and Canada. Meanwhile, Asia-Pacific is

poised for noteworthy growth in the forecast period, fueled by robust economic

expansion and ongoing developments in the services sector. This encourages

business enterprises in the region to make substantial investments in IoT in

manufacturing, aiming to sustain growth and enhance productivity.

Some of the major

players operating in the internet of things (IoT) in manufacturing market are:

• Cisco Systems, Inc. (U.S.)

• Siemens (Germany)

• ABB (Switzerland)

• Huawei Technologies Co., Ltd (China)

• Hitachi Vantara LLC (U.S.)

• Qualcomm Technologies, Inc. (U.S.)

• Rockwell Automation (U.S.)

• General Electric (U.S.)

• SAP SE (Germany)

• Microsoft (U.S.)

• Fujitsu (Japan)

• IBM (U.S.)

• Robert Bosch GmbH (Germany)

• Uptake Technologies Inc. (U.S.)

• Litmus Automation Inc. (U.S.)

• ClearBlade, Inc. (U.S.)

• Schneider Electric (France)

• Tech Mahindra Limited (India)

• Zebra Technologies Corporation (U.S.)

• Verizon (U.S.)

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/2483

Thanks for reading

this article; you can also get individual chapter-wise sections or region-wise

report versions like North America, Europe, or Asia.

If you have any

special requirements, please let us know and we will offer you the report as

per your requirements.

Lastly, this report

provides market intelligence most comprehensively. The report structure has

been kept such that it offers maximum business value. It provides critical

insights into the market dynamics and will enable strategic decision-making for

the existing market players as well as those willing to enter the market.

Leave A Comment