India’s Wearable Market Grew 29.2% YoY to 48.1 Million Units

According

to International Data Corporation’s (IDC) India Monthly Wearable

Device Tracker, India’s wearable market shipped a record 48.1 million units in

3Q23 (July-Sep), a healthy 29.2% year-over-year (YoY) growth. With this, the

market has shipped 105.9 million units in the first three quarters of 2023,

which is more than 100.1 million units shipped in 2022. Continuous new model

launches by the brands across price points and product categories is the key

reason for this momentum. Apart from the new smartwatch and earwear models,

smart rings became prominent in 3Q23. The overall average selling price (ASPs)

declined by 20.4% from US$27.2 to US$21.7.

Smartwatches remained the fastest growing category with 16.9

million units, growing by 41.0% YoY as incumbent vendors shipped aggressively

to stock for the upcoming festive season. Heavy discounting and offers across

channels led to a 35.3% YoY drop in smartwatch ASPs to US$26.7 in 3Q23.

However, the ASPs grew QoQ (quarter-on-quarter) by 4.3%, up from US$25.6 last

quarter, due to the increased share of advanced smartwatches from 1.5% to 2.4%,

as well as the introduction of premium options in the basic smartwatch segment.

Within wearables, the share of earwear dropped to 64.4% from

67.3% a year ago, but shipments still grew 23.6% to 30.9 million units. Within

earwear, the Truly Wireless Stereo (TWS) segment took 68.4% share with strong

growth of 46.7% YoY, whereas neckbands declined by 6.9% YoY. ASPs for TWS and

neckbands stood at US$19.5 and US$14.2 with declines of 17.1% and 4.6% YoY,

respectively.

“Brands have upped the game with high-end specifications at

entry-level pricing. This combined with high-decibel marketing campaigns and

promotions will drive 4Q23 shipments, resulting in strong double digit annual

growth in 2023. In 2024, we will see an enhanced focus on localization of

UI/UX, in-house app integration, SIM-based or standalone calling and Wi-Fi connectivity

on basic smartwatches,” says Vikas Sharma, Senior Market Analyst, Wearable

Devices, IDC India.

Offline channels reached a record 31.5% share, the highest since

1Q21, growing by 58.3% YoY. Online channels grew by 19.1% YoY due to multiple

upcoming sales events and festive stocking. This underlines the importance of

an omnichannel presence for brands, especially as they expand into Tier 3/4

cities.

The smart ring category is generating a lot of interest from

consumers, particularly due to the interesting form factor and several launches

in the past few months. “Smart rings add novelty to the wearable device space,

with brands trying to position it as a fashion accessory and a non-intrusive

health device. While currently there are very few models, we can expect more

mainstream brands launching more affordable options next year,“ says Upasana Joshi, Research Manager, Client

Devices, IDC India.

Ultrahuman leads the Smart Ring category with an impressive

75.5% market share, followed by Pi Ring at 10.9%, and boAt (Imagine Marketing)

with an 8.2% market share in 3Q23.

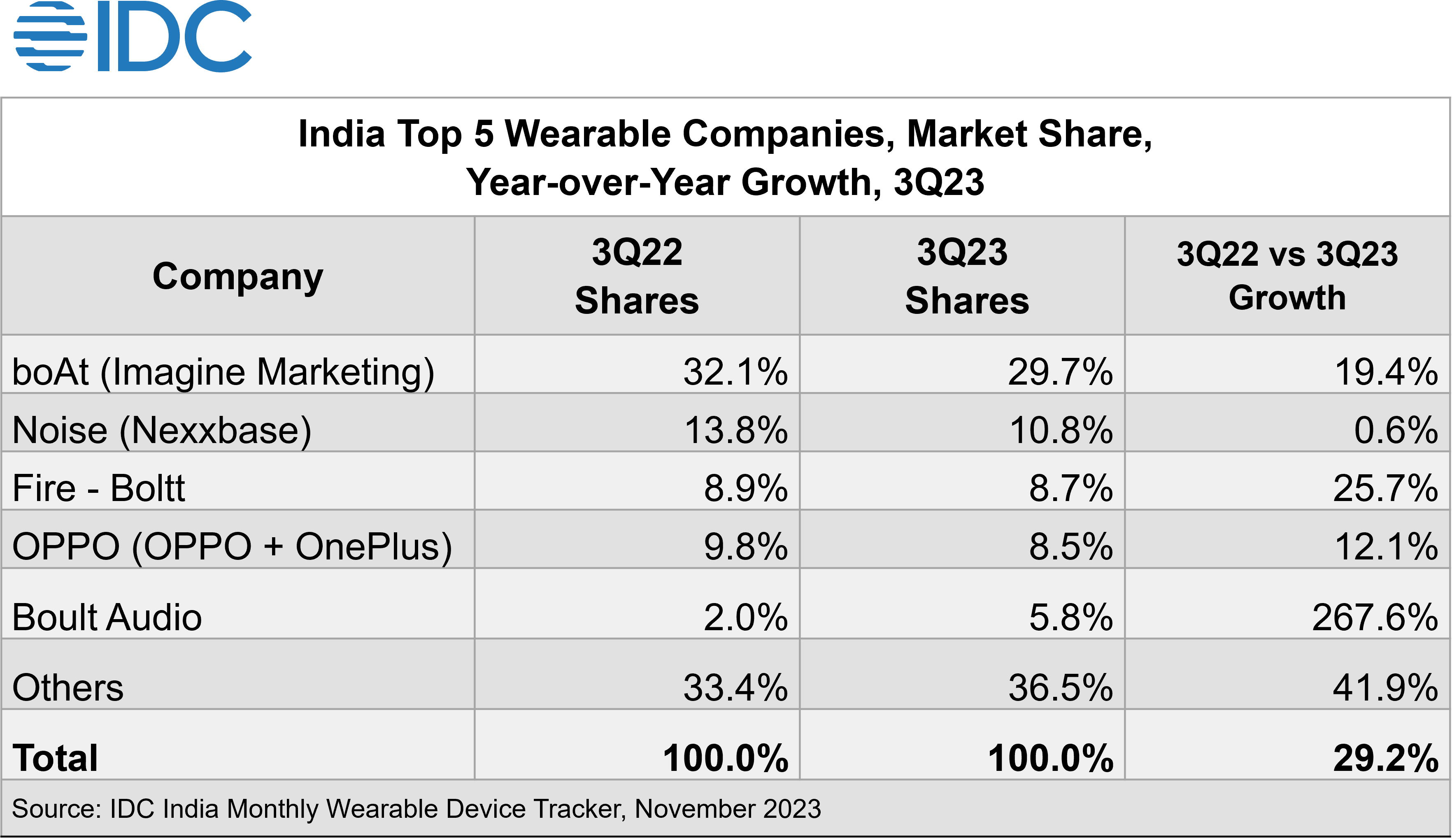

3Q23 Top 5 Wearable Company Highlights

boAt (Imagine Marketing) continues to dominate the

overall wearable market with 29.7% share, growing by 19.4%. In TWS too, it

maintained leadership with 37.9% share, 33.3% growth YoY. It stood third in the

smartwatch category with 14.2% market share. Airdopes 131, 161,141 and Alpha

accounted for 42.6% of its TWS shipments. The Storm Call and Storm Call 2

contributed to 14.9% of its smartwatch shipments. It continues to partner with

Qualcomm, Dolby, and Dirac to bring new audio related features and is also

expanding its India based manufacturing partner panel.

Noise (Nexxbase) stood second in overall

wearables with 10.8% share and flat 0.6% YoY shipment growth. It dropped to

second in the smartwatch category with 20.7% market share and maintained its

fourth position in the TWS segment at 7.7% share, growing by 20.4% YoY. The

Noise Colorfit Pulse 2 Max, Icon 2 Elite, Icon 2 and Crew contributed 35.8% of

its smartwatch shipments. Noise announced its foray into the smart ring segment

in 3Q23.

Fire – Boltt stood third with 8.7% share and 25.7%

growth YoY in the overall wearable category. It reclaimed leadership in the

smartwatch category with 23.6% share, growing by 27.0% YoY. A balanced product

portfolio across price segments, with robust omnichannel presence cemented its

position. The Phoenix Series and Ninja Call series led its smartwatches in

3Q23. Furthermore, several exclusive brand kiosks were opened to offer a

firsthand consumer experience in the offline channel.

OPPO (OPPO + OnePlus) stood fourth with 8.5%

share and growth of 12.1% YoY. The company stood third in TWS with 8.0% share,

growing by 30.4% YoY, and stood second in neckbands with 26.3% share. The Buds

2R, Enco Buds 2 & Nord Buds 2 accounted for 74.7% TWS shipments. An ANC

variant of the well-received OnePlus Bullets Wireless Z2, alongside the Nord

Buds 2r, were launched, with emphasis on affordability. Additionally, the Oppo

Enco Air 3 with ANC was launched.

Boult Audio stood fifth with a 5.8% share and

267.6% YoY growth in 3Q23. It retained second place in the TWS category with an

8.6% share and 387.7% YoY growth. Airbass Z40 and Y1 contributed 51.4% of its

shipments in the TWS category. However, the company slipped to sixth position

in smartwatch category with 55.8% of its shipments from models like the Drift,

Crown, and Drift Plus. The introduction of new metal smartwatches should

significantly boost shipments in October/November. The company also forayed

into offline channels in 3Q23.

Others - Titan and BeatXP placed fourth and fifth in the

smartwatch category with 5.1% and 3.4% share respectively. In TWS, Samsung

(JBL+Infinity+Samsung) placed in fifth position with 3.5% share with 45.1%

growth YoY, while Mivi (Seminole) moved to sixth position with 3.5% share.

Leave A Comment