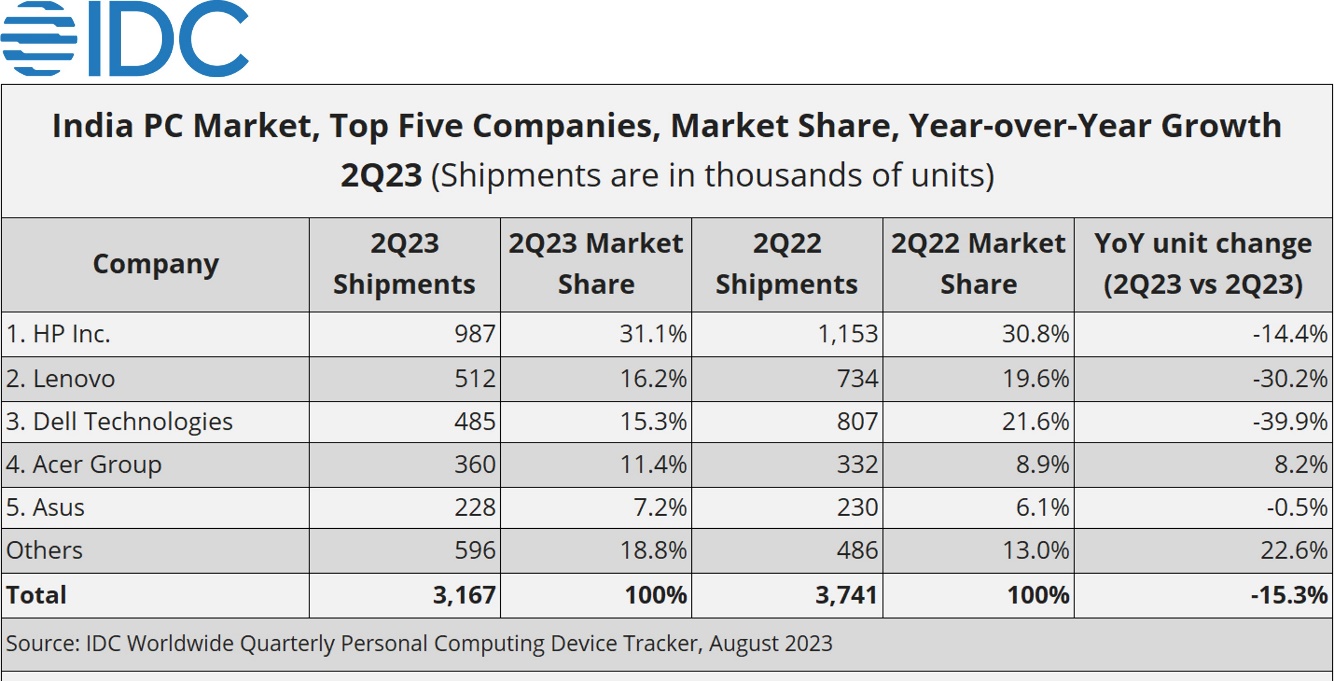

India's PC Market Declined for a Fourth Consecutive Quarter, Shipping 3.2 Million Units in 2Q23

The

India traditional PC market, inclusive of desktops, notebooks, and

workstations, continued to struggle as it shipped 3.2 million units in 2Q23.

Despite growing by 5.9% quarter-over-quarter (QoQ), it declined by 15.3%

year-over-year (YOY) in 2Q23 (Apr-Jun), according to new data from the International Data Corporation (IDC) Worldwide Quarterly Personal Computing Device Tracker.

In 2Q23, all the product categories declined YoY. While the volume

driver notebook category declined by 18.5% YoY, the desktop category, which had

been on a growth trajectory until last quarter, also declined by 7.0% YoY. Both

the consumer and commercial segments were in the red, declining by 17.0% and

13.8% YoY respectively.

The education and government segments continued to drive the PC

market while the enterprise segment continued to struggle. Government-driven

education projects for a few states like Madhya Pradesh, Gujarat, and Tamil

Nadu propelled the education segment, which grew by 43.7% YoY. The fulfillment

of several state high court orders helped the government segment grow by 8.2%

YoY. Premium notebooks (>US$1,000) declined by 30.7% YoY primarily due to

very limited enterprise orders. However, there was some optimism as the premium

notebook category witnessed a strong 39.0% QoQ growth. The online channel

declined by 15.8% YoY but has started picking up and is expected to do well in

next quarter.

“The India consumer PC segment has started showing signs of

recovery as market sentiment is improving. Despite a YoY double-digit decline,

it clocked a strong double-digit QoQ growth. PC vendors successfully ran

college campaigns and got good traction. The improved performance of their

e-tail channels has also provided much needed respite to the consumer segment,”

said Bharath Shenoy, Senior Market Analyst, IDC

India.

Top 5 Company Highlights: 2Q23

HP Inc. led the market with a share of 31.1%

in 2Q23 anda strong showing in both the consumer and commercial segments. While

strong demand for gaming notebooks and good traction in brand stores helped the

vendor to hold a share of 29.5% in the consumer segment, strong demand in

government and education segments helped the vendor to hold a commercial share

of 32.6%. It also witnessed a YoY growth of 9.5% in the SME segment.

Lenovo stood second with a share of 16.2% but declined by 30.2%

YoY. It was third in both the consumer and commercial segments with a share of

13.0% and 18.9% respectively. The vendor, however, was second behind HP in the

SME segment with a share of 25.8%.

Dell Technologies stood third with a share

of 15.3%. The vendor was marginally ahead of Lenovo in the commercial segment

as it held a share of 19.1% but held a meagre 11.0% share in the consumer

segment. The vendor focused on profitability and stayed away from tenders where

aggressive pricing is required. Also, it shipped lower volume as it restored

channel inventory to a healthy level.

Acer Group stood fourth with a share of 11.4%.

The vendor is faring much better in the desktop category as it came second

behind HP with a share of 21.9%. It led the commercial desktop category with a

share of 29.8% driven by increased demand from the government segment. It also

witnessed strong demand in the consumer segment which eventually helped the

vendor to grow in the total market by 8.2% YoY.

ASUS held fifth

position with a share of 7.2%. With strong offline channel expansion, the

vendor continued to do well in the consumer segment as it came second behind HP

and ahead of Lenovo with a share of 14.8%.

Commenting on

the outlook, Navkendar Singh, Associate Vice President, Devices Research, IDC India,

South Asia & ANZ said, “The PC market has been sluggish over the last few

quarters as enterprises and SMEs have been delaying their PC procurement.

However, with import restrictions expected to kick in from November, we expect

vendors to push channel inventory in both the consumer and commercial segments.

SMEs and enterprises might also fast track their PC procurement anticipating a

price increase from November."

Leave A Comment