Blockchain in Retail Market is Growing at 84.6% CAGR through 2026

According to the report, the global blockchain in

retail market size garnered $83.00 million in

2018, and is estimated to reach $11.18 billion by 2026, growing at a CAGR of

84.6% from 2019 to 2026.

Rise in need to ensure quality, reliability,

authenticity, and product safety, an increase in investment by retail

industries in blockchain-based solutions, and an upsurge in transaction

transparency fuel the growth of the global blockchain in retail market. On the

other hand, scarcity of skilled experts hampers the growth to some extent.

However, rapid change in the retail sector and international trade is expected

to create a number of opportunities for the key players in the industry.

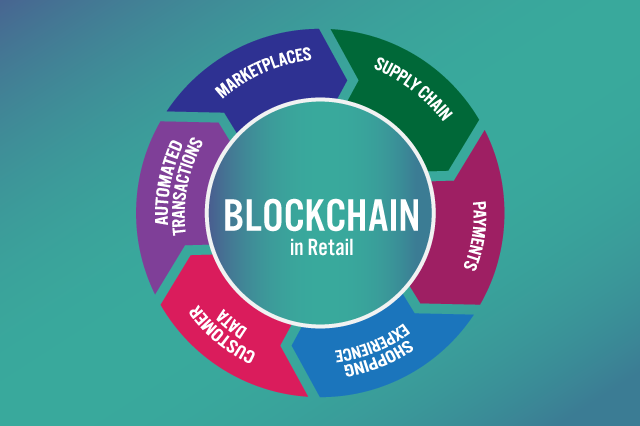

Blockchain as a digital technology has progressed

a lot in recent years. And among all the end users, the financial sector has

been experiencing a major transformation. However, retailers are also exploring

the potential applications and benefits of blockchains across the retail

industry. Online payments, card-based payment methods, and loyalty rewards and

management have become dominant and gained huge traction in the recent past

and, blockchain is expected to support all these changes by enabling increased

speed of transaction and real-time processing.

Retailers need to collaborate with numerous

partners and external stakeholders on joint projects to test blockchain

applications in their business. These factors are expected to create major

blockchain in retail market opportunity in forthcoming years.

Furthermore, with suitable and appropriate

collaboration, blockchain can enhance supply chain visibility which can improve

sales forecasting and inventory control while creating product authenticity and

provenance. In addition, blockchain can reduce costs and increase operational

efficiency by eradicating the need for redundant databases and management

systems across retail organizations.

The current compliance processes that are being

used among retailers are time-consuming, which can lengthen other processes

involved in the retail supply chain. The capability of blockchain to work in

real-time on shared common datasets and to enable secure compliance management

offers better visibility to retailers. Thus, these features reduce the

additional efforts for retailers, which in turn increases the adoption rate of

blockchain technology for compliance management. Also, the traditional trade

process in asset management involves huge cost and risks when it comes to

cross-border transactions.

Based on components, the platform segment held the

major share in 2018, generating more than two-thirds of the global blockchain

in retail market. The growing need for safe and secure transmission of data

across supply chain is driving the growth of this segment. At the same time,

the services segment would register the fastest CAGR of 89.3% during the study

period. Blockchain services allow retailers to bring innovation across the

industry and helps them create new value for their businesses, which augments

the growth of the segment.

Based on application, the payments & smart

contracts segment contributed to more than two-fifths of the global blockchain

in retail market in 2018, and is expected to retain its dominance till 2026.

This is attributed to increase in demand from enterprises to fill the analog

gap between contracts, increase in need to streamline online payments, and cut

down fraud. On the other hand, the loyalty and rewards management segment,

would grow at the fastest CAGR of 97.0% from 2019 to 2026. The growing need to

streamline the development and exchange of loyalty points across retailers and

various programs is the major factor driving the growth. In addition, with a

time-stamped and tamper-proof database of transactions, retailers can track and

secure loyalty program transactions transparently which leads the market

growth, as well.

On the basis of organization size, the large

enterprises segment dominated the global blockchain in retail market in 2018

and it is expected to remain dominant throughout the forecast period. On the

contrary, small & medium size enterprise segment is expected to exhibit

highest growth throughout the forecast period. The increase in need to shift

from conventional business models to digital business is the key factor driving

retailers to adopt blockchain solutions hence, fueling the blockchain in retail

market growth of this segment.

Based on geography, North America accounted for

more than two-fifths of the global blockchain in retail market revenue in 2018,

and is anticipated to dominate throughout the forecast period. This is

attributed to the presence of major market players, and the growing concerns of

fraud in the regions drives the growth.

Leave A Comment